The First Treasury Bond Auction of the financial year and the Yields couldn’t have been any Better for investors.

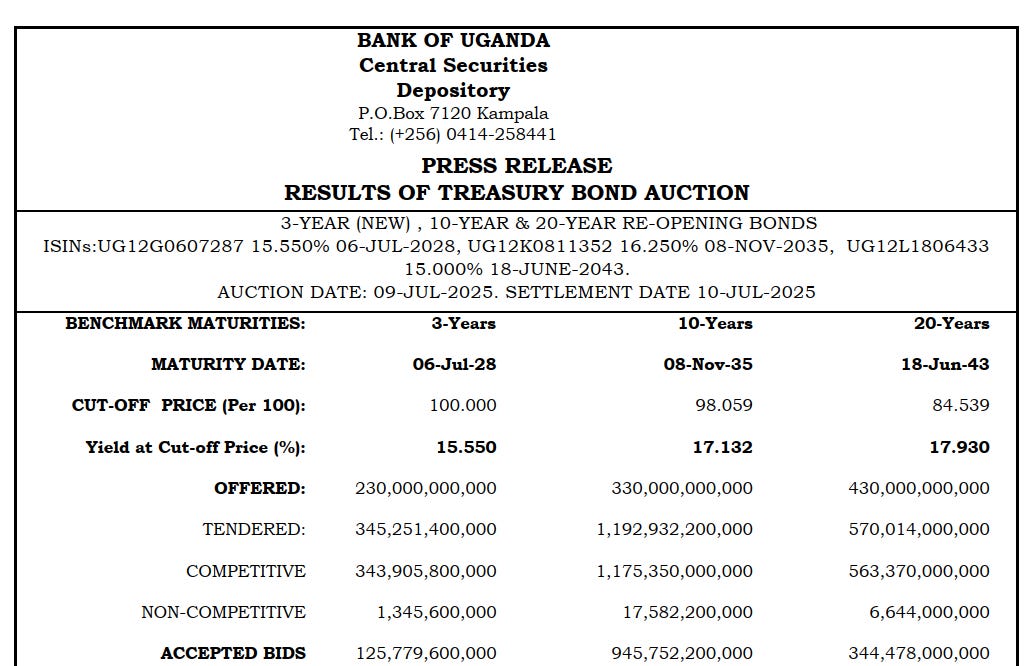

From today's treasury bond auction, the 20-year treasury bond had a cutoff yield of 17.3% with a cutoff price of 84.539 for every 100 shillings. The 20 Year Bond is paying a coupon tomorrow for all those who held it by July 9, 2025

(This excludes all of us who purchased it at this auction, as the settlement for your purchase occurs on the same day as the coupon payment. Consequently, the clean price of the purchased 20-year bond is equal to the dirty price, which is reflected in the total discount obtained.)

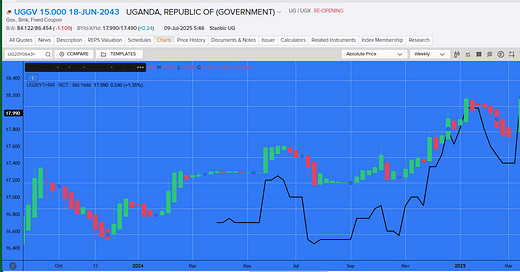

20 year bond trading on the secondary market.

It's fascinating to note that the 15% coupon 20-year treasury bond is trading at a 15% discount. This means that even those purchasing from the secondary market is securing an incredible deal. (If you missed out and want to secure a good priced Bond, reach out on 0771404377 whatsapp. )

Anyone buying a treasury bond right now should anticipate yields above 17.5%, particularly for the 20-year treasury bond.

The people’s favorite. the 10 year 16.25% coupon rated bond.

For the first time in over 3 years the 10 year 2035 16.25% coupon rated Bond that was once a 15 year bond is back on the market with people bidding over Ugx 1 trillion for this amazing bond and government accepting over 900 billion in this auction for 1 bond alone.

The 10-year bond alone boasts a yield of 17.132% and trading on the secondary market at around 17% yield from a buy side

10 year bond trading on the secondary market.

The three-year bond is also impressive at 15.5%. This is nothing short of incredible for investors for a medium-term investment.

With non-competitive bids exceeding 25 billion, I'm excited for everyone who has invested.

hello Mr Alex, thank you for the updates, but what does this mean for commercial banks especially on the lending rates. does this mean that some one can take a loan of 16% and earn 17% from Bonds? is it advisable?

hello alex. Peter here. I would like to learn more about these bonds with the aim of investing