Today for the first time, Airtel Uganda as the company released its annual financial statements for the year ending December 31, 2023. This is the first such release since the telecommunications company went public in November 2023.

Worthy to note, in the four months since its Initial Public Offering (IPO), the company’s share price has slipped by 13%, moving from its peak value of UGX 100 per share recorded on November 7 to sit presently at UGX 87 per share.

Performance of the Company

Taking a closer look at the company's performance, the numbers are mixed.

Revenue

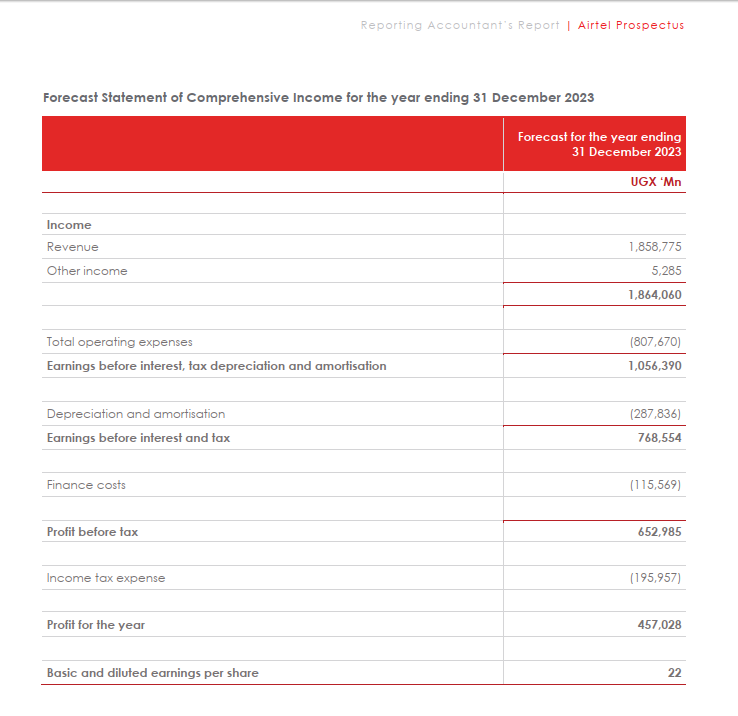

Revenue showed a 12% year-on-year increase in 2023 from 2022, reaching UGX 1.78 Trillion. This, however, falls significantly short of the anticipated revenue cited in their IPO prospectus, translating to an UGX 80 billion shortfall. The IPO forecasted revenue nearing UGX 1.86 Trillion as of December 31, 2023.

The prospectus Numbers

Profit for the year

Moreover, the Profit After Tax witnessed a decline of about 9%, sliding from UGX 325 billion in 2022 down to roughly UGX 296 billion in 2023.

More alarming is the fact that the IPO had projected a Profit for the year of UGX 457 billion, a target missed by over UGX 160 billion. This disparity perhaps explains why the Basic Diluted earnings per share at year-end stood at UGX 7.4 per share, a far cry from the projected UGX 22 per share.

Why, in spite of a nominal revenue shortfall of just UGX 80 billion, did profits plunge so dramatically below the profits forecasted only a few months prior?

Airtel Money Questions

Exploring the Close Ties between Airtel Uganda and Airtel Mobile Commerce Uganda

A review of the financials reveals that Airtel Mobile Commerce Uganda (also known as Airtel Money) were paid related party expenses totaling UGX 206 billion as of December 31, 2023. This represents an increase from UGX 160 billion in the previous year. However, Airtel Uganda's revenue from Airtel Money was just UGX 29 billion. This suggests that funds are largely flowing in one direction: from the publicly listed Airtel Uganda to the unlisted Airtel Money.

Notably, Airtel Uganda has also signed a drawdown facility with Airtel Money to the tune of UGX 75 billion for which UGX 40 Billion has already drawn down by Airtel Uganda.

Dividends

In terms of dividends, Airtel Uganda anticipated disbursing a total of UGX 513 billion to shareholders. However, the total payout has reached just below the UGX 300 billion mark, specifically UGX 294 billion.

This analysis serves to underline both achievements and lapses, providing stakeholders with an informed perspective on the telecom firm's performance in 2023.

Projected

The total Dividends payment in 2023

Happy Investing.

Alex Kakande