Written by an esteemed member, preference is to keep it anonymous.

Today, I have completed writing my 2025 goals. I dedicated 30 minutes per weekday since December 25, 2024, to this task to ensure I capture everything I need and plan ahead.

Allow me to share extracts with you and your readers for my Health, Finance, and Investment Goals in the hope that they are encouraged to set their 2025 goals.

He notes in our conversation “my goals document has reached 20 pages as I have added more actionable steps to make me even more efficient.”

Health & Fitness

As a Kampala middle manager level worker, maintaining my health and fitness has been my most important goal for the past three years. I aim to sleep an average of 8 hours a day and go to the gym three times a week, with two 30-day rest periods within the year. I plan to fast for 36 hours a week from Tuesday 6 pm to Thursday 6 am.

My goal is to maintain a body weight above 80 kg, with each meal consisting of 60% protein intake. I plan to average at least 10 km a week with month-long rests, not exceeding 8 km in any one run for the year 2025. Additionally, I will walk an average of 20 km per week.

I plan to go for a comprehensive body checkup from head to toe, grow and nurture my hair, and eat breakfast after 8 am and dinner before 7 pm to achieve daily intermittent fasting on days I don't fast.

I will drink 5 liters of water every day, practice yoga for body flexibility, and do ice baths and sports massages for muscle recovery once a month.

I will cook 2 to 3 meals at home, brush my teeth before bed and floss, and continue to follow the 10 pm sleep circadian rhythm at least 4 days out of 7 in a week. I also plan to increase my health budget from 2 million to 8 million for the year 2025.

Finances

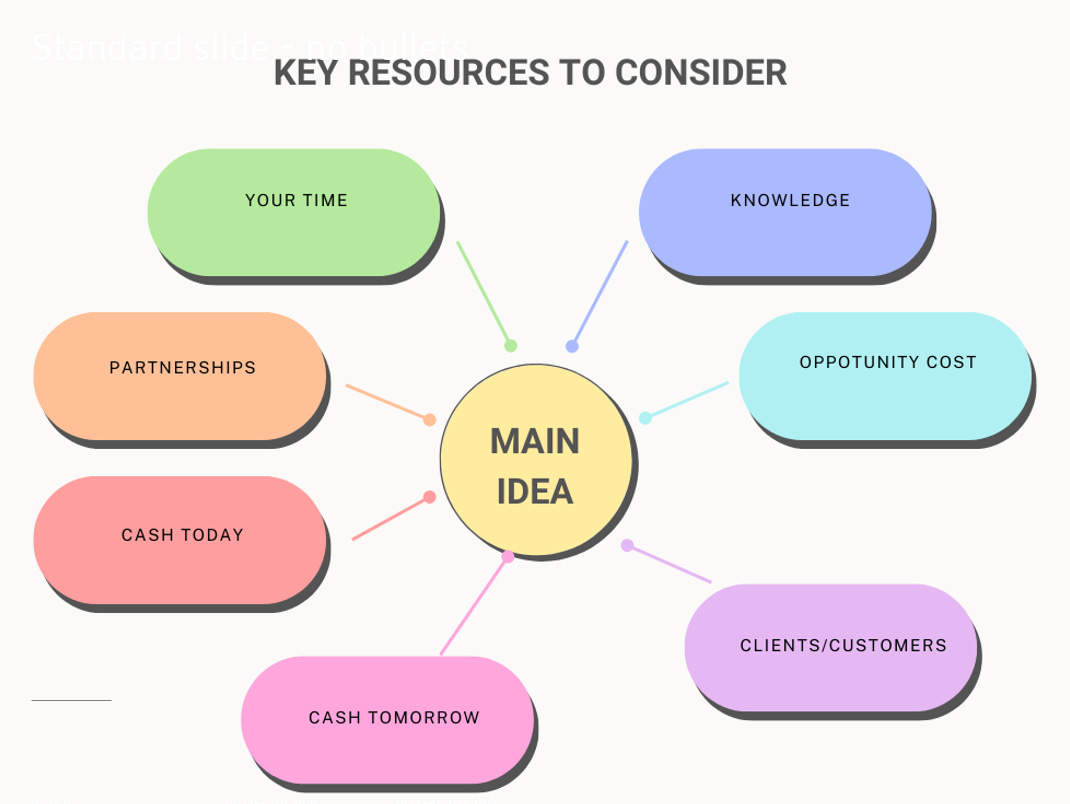

I’m intentional about my finances and I want to earn some real money in this year and the years ahead.

In terms of earning, I aim to work towards a passive income of 300,000/= per day, which would mean earning around 100 million in 2025 and beyond.

This is aggressive but achievable, as will be broken down in the investments plan below. The passive income

For saving, I plan to invest and re-invest 70% of all money earned.

The best thing you can do for your money is to allow it to compound over time, and this can only be achieved by re-investing every income that comes in before any expenses. This strategy allows your money to generate more income. Ideally, I would aim to spend only the returns generated from my initial investments, allowing the principal investment to continue compounding along with its subsequent returns.

Regarding expenditure, I will keep my daily spending between 70,000/= and 150,000/=, allowing it to oscillate within 30% of my earnings, so new earnings allow for some extra expenses.

If I can manage to earn 300,000/= per day while keeping my expenses to around 80,000/=, this means I will be re-investing over 200,000/=, which is around 73% of my daily income. This is the perfect strategy.

Gifting. I will maintain my gift expenses to where they make an impact and keep wedding contributions to 100,000/=.

I pay for what I eat. If you invite two of us, I give you 200,000 as contribution to just pay for my and my companion’s meal.

“Although Kakande believes UGX 100,000 is low, he prefers it to remain at pay what you eat, as people should marry when they can afford it and do what’s within their means. “

Leverage and Loans.

I love loans and I have found a way to utilize them for my investments growth. I also plan to increase my expenditure on loan interest to ramp up investment positions and increase my access to long-term debt to UGX 80 million at price-friendly loans.

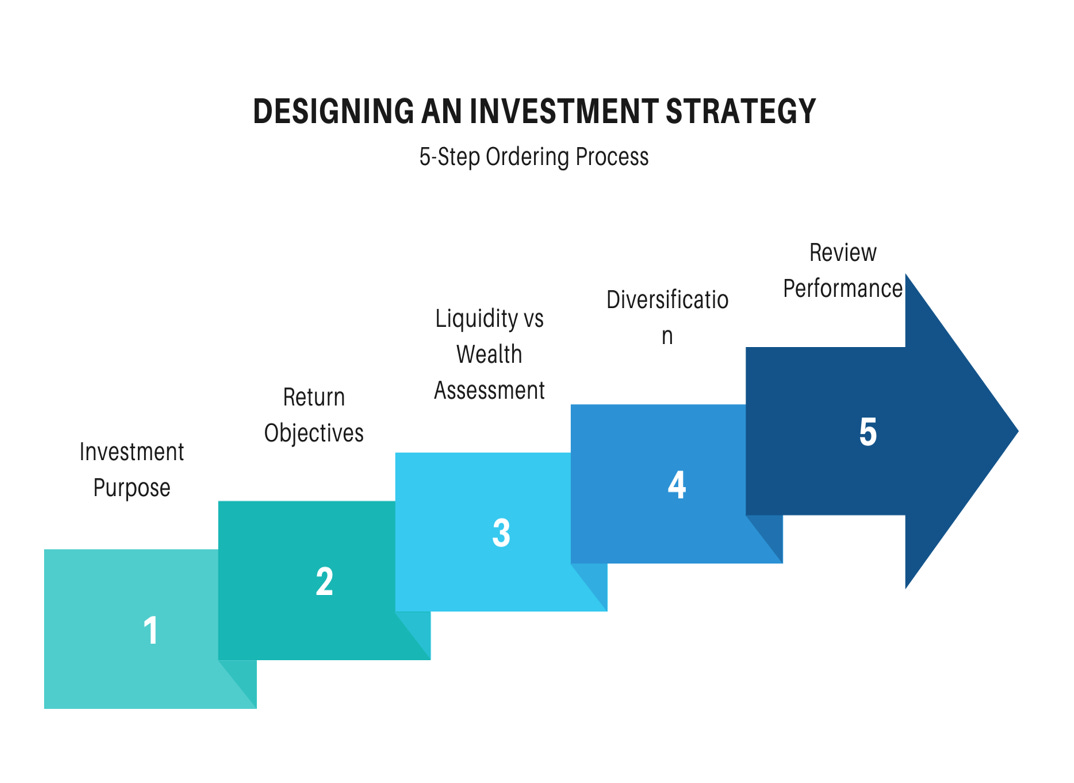

Investments

Equities.

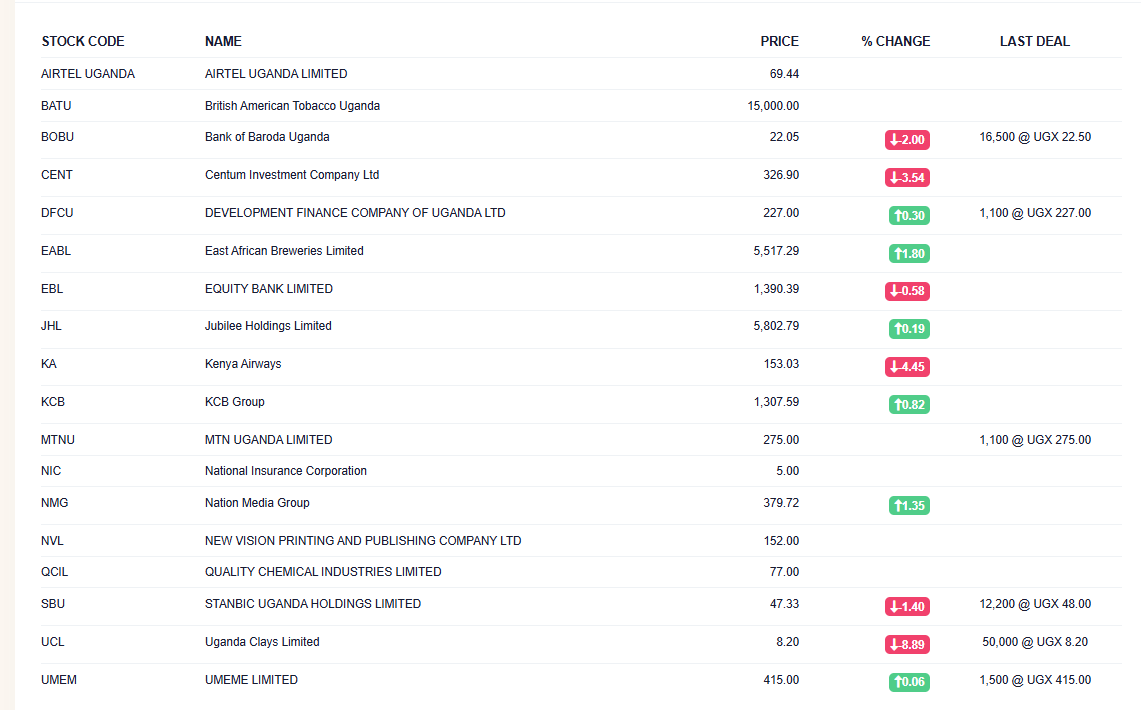

I plan to hold onto my Stanbic Bank and DFCU Bank shares until 2042, as the potential for growth by these two is enormous. They have potential and have a special niche that any stock Investor should love

I will sell my New Vision and Uganda clays shares at half price to get them off my books, as I have suffered enough with that stock.

Treasury Bonds.

I will buy 4 bonds with a minimum targeted net return of 14%, scattered around the year to have 12 separate bond interest coupon payments of a minimum of 1 million.

This will cost around 80 million, and I plan to use Kakande’s services to monitor which bonds to buy that would help yield a net return of 1 million per month year-round.

The writer also attended my masterclass and we have fully worked on these plans and I love to see them coming to life and him embracing some Bonds in his portfolio.

SACCOs are the future.

I will increase my holding in Village Sacco to 50 million from the current 10 million and in Millennium SACCO to 20 million from the current 5 million.

I will pay attention to Excel Construction governance and nurture a movement from downstream to upstream oil & gas business, as this is my baby, and the plan is to scale it up this has a potential to a UGX 300 Million turnover/Revenue in a few years from now.

By setting these detailed and actionable goals, I hope to achieve a balanced and successful year in 2025.

Very concise, right down to water intake! I’ve taken notes.

I am picking a leaf