A Step-by-Step Guide to Investing in Treasury Bonds and Bills in Uganda

Jan 14, 2025

Friends,

Many of you have inquired how does someone invest in Treasury securities, in this email, I break down the step-by-step guide of Investing in Treasury securities.

There are two types of Secuties.

Treasury Bills:

These are short-term instruments that allow the public to lend money to the Government for periods of 91 days, 182 days, and 364 days. They are issued at a discount, meaning you buy them for less than their face value and receive the full amount at maturity. For example, you might buy a Shs 10,000,000 Treasury bill for Shs 8,860,200 and receive Shs 10,000,000 when it matures a gross profit of Shs 1,319,800.

The Treasury Bills have a tax element of WHT 20% and thus on the Shs 1,319,800 profit you would have made, you would pay a tax of Shs 263,960

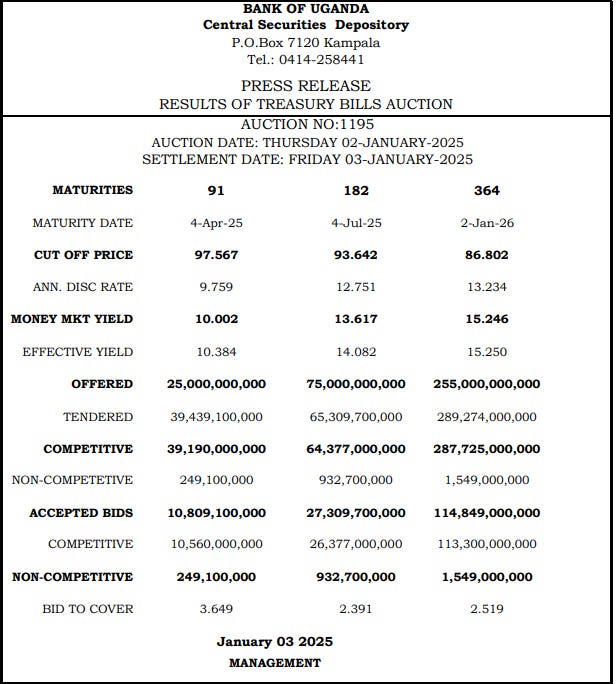

The results of the recently concluded Treasury bills.

Treasury Bonds:

These are long-term investment instruments, allowing the public to place funds with the Government for periods of 2, 3, 5, 10, 15, or 20 years. They pay interest periodically, typically every six months.

From a Withholding tax for the 2, 3 and 5 years are typically 20% for the coupon income you make.

How the numbers would look like for someone investing in a 3-year bond before compounding of your investments.

For 10-, 15-, and 20-year treasury bonds, the Withholding tax is 10% of the coupon income.

How the numbers would look like for someone investing in a 10 year bond before compounding of your investments

Who Can Invest?

Any Ugandans with a commercial bank account can invest in Treasury Bonds and bills.

All you have is to go to your commercial Bank Branch and ask for the CSD Account opening forms and they will provide it to you and fill it up and be ready to invest.

Investors can participate in the Uganda government securities market through:

Primary Auctions:

These are conducted as per the Auction Calendar frequency on the BOU website. This is where new securities are issued or are re-opened. Investors submit bids to buy these securities directly from the government though their commercial banks.

To buy from the primary market, you must fill up form CSD Form 2 with your commercial bank and its advisable to do so in 2-3 days before the Auction date.

All successful bids are settled by directly debiting the commercial bank accounts at the Central Bank for the value of the securities/investments through a particular commercial bank. This process ensures transparency and efficiency in the allocation of government securities. If you go through the non-competitive bidding which limits you to just UGX 200 Million, then your bond will be fully allocated.

Secondary Market:

Available any working day, this is where existing securities are bought and sold among investors. This market provides liquidity, allowing investors to sell their securities before maturity if needed

There is no WHT when selling or buying in the secondary market. This tax policy ensures that the government collects revenue from interest earnings while providing some relief for long-term investments.

Thanks for the enlightement. Are there any advantages of buying from the primary market over buying from the secondary market, and vice versa?

Very well written article. It may take me a few reads to fully grasp the concepts but this is a good start for a lay person. There tends to be a lot of financial jargon that makes it hard to comprehend even your own interest, lol!