Long but worthy 300th of this publication - +256 771 404 377

And if you liked this email, help me share it widely to reach everyone who wants to start their journey

First, All you need to Invest in a Treasury Bonds is UGX 100,000 and in Unit Trust is 50,000 with as minimal top up of as low as UGX 10,000. So whatever your circumstances are, you can Investment in the Treasury Bonds and Unit Trusts.

The last few weeks have seen a passionate discussion online, especially on the X-platform, with a number of individuals comparing investments. I am advocating for many people in Uganda to take a step and start investing in treasury bonds for many reasons, but primarily because they are offering better yields right now on average compared to traditional investments, especially real estate, rentals, and apartments for income generation.

This has sparked a heated discussion with quite a number of people and brought in new individuals who want to understand what treasury bonds are, why they should invest in them, and what makes them special. What are the opportunities in them? Why should they move away from investing in other products they have known all along and come and invest in treasury bonds?

But before we go deep into this conversation, I want us to set the right tone.

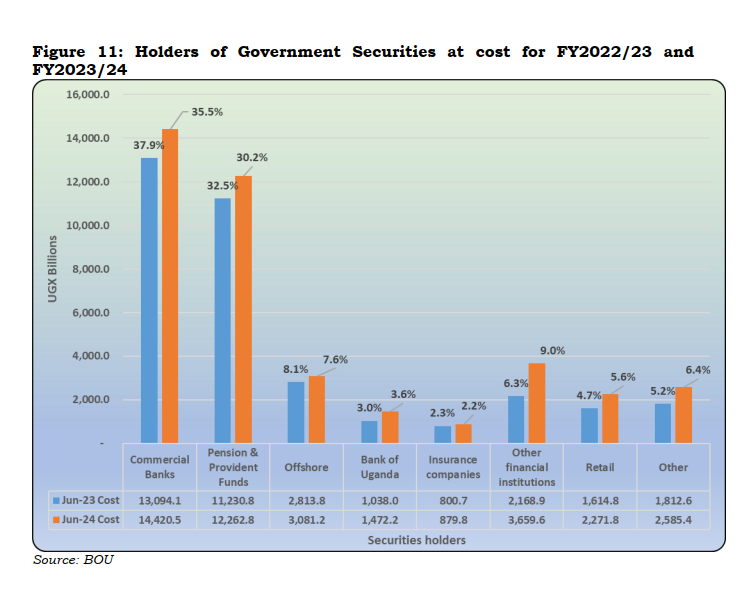

The Photo below shows the share of Government Treasury Bills and Bonds in 2020 and 2022. By March 21, the retail Investors (You and I who were invested then) owned just around UGX 670 billion on bonds & bills, and the other big players owned everything else. A just 2% stake in one of the most lucrative Investment products.

By June 2024, the retail Investors owned now 5.6% of the total Securities. Double the rate or around UGX 2.7 trillion.

The commercial Banks, Pensions, Insurance companies and offshore Investors continue to own the majority of the Government Securities. Make no mistake, that if you reject to invest in whatever patriotic capacity you want to think this over, that the big players will slow down. No, they won’t, they are racking in serious amount of money in this trade and it’s only fair we join in directly and start eating big too. So please, read the letter below and take your rightful place in this journey.

My passionate plea.

This discussion is an argument for investing in treasury bonds. It's targeting those of us who, by the very nature of being Ugandans, are already working against the tides. Many of us who are fully employed and have a starting capital of zero or are earning anywhere from 300,000 to 10,000,000 or less than 1,000,000 in investment income.

We are the majority. The alternative is the minority—the alternative who are successful in business, the alternative who are successful in entrepreneurship, the alternative who are extremely successful in careers. They are the minority.

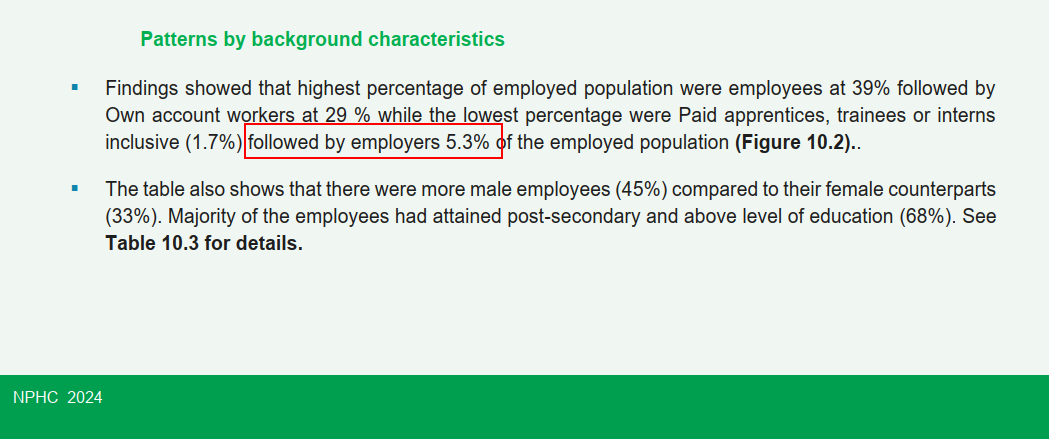

Recent data shows only 5.3% of the population are categorized as Employers. The rest of us are Employees or paid apprentices. But yet we all can be Investors.

The majority of us who are earning these basic salaries in Uganda, who are trying to better ourselves every single day, for us, every 100,000 matters. If we are to deploy it to bring some return, it matters. We are not risk-averse because we want to be; we are risk-averse because we do not want to lose the little we have. The Majority of us who, if we are to lose UGX 200,000 in a night, we will feel it and know it.

We are not risk-averse because we are weak; we do not want to take un-calculated risks. We are risk-averse because the cost of losing the little we have is much more painful than the gain we would get if we were to make a 10% gain in the investments we make. So we make decisions to protect that little we have.

You are not a coward to seek out the passionate route as long as it guarantees you some return. You are not a coward to chase that career, to look for a job that is going to maybe guarantee you a decent living as compared to entrepreneurship and business, especially when you know every now and then they tell us almost 80% of businesses fail.

You are being more strategic to say, "If I have 1,000,000, how do I deploy it better without losing it than risking it and losing everything?" The cost of losing everything is more catastrophic, and that is what guides us. I am not targeting this for the highly successful people. Of course, they can do anything; they can make an investment and lose a billion in one year and still survive. Some of us can't risk losing even 10 million because that is everything we have. So what do we do? That's where investments like treasury bonds come in.

This includes our sisters who are employed in all manner of countries as housemaids and the majority of us whose prospects are not many. The only prospect we have is to use the little we have to grow it. This discussion is for those who are still in what many term as the "food war."

Think of our brothers and sisters in the Middle East who, against all odds, take risks to earn an extra 1,000,000 or 2,000,000 per month, not because they don't want to stay home and live a better life and work, but because there are no opportunities. Those are the people you want to take advantage of such a product.

Imagine, one of your sisters who is heading to Middle East, young and strong, and before they board the plane, they open up an Account with a NSSF Smart life, a treasury bond account or Unit trust account and dedicate around 5-10 millions per year to investments for around 5-10 years. they will return to an over 150 million in portfolio paying them over 1 million a month. That’s Investment

Do not tell them that they are risk-averse and their investments in treasury bonds are curtailing their industrial entrepreneurship. What entrepreneurship? If all they have is what they have earned and saved for 5 years, what do you want someone who is based in Saudi Arabia to do with their money? Open a shop? Can we get real now?

Alternative? Opening Shops importing stuff from China? And then we call Bond Investors lazy?

What does importing things from China and putting them in a shop to earn a 10% margin have to do with entrepreneurship versus that person investing in a treasury bond that can allow them to grow? Investing in a money market fund that allows their money to compound so that for the two years they are not going to be losing their money but their money is going to grow, and by the time they come back, they might have a chance to start their life with a compounded effort.

The Capital Markets provide the best alternative options in terms of return, safety to our people.

They can start their life with some assurance instead of risking everything. This is not a plea to the wealthy and the mighty; those who have already made it, whatever businesses and executions they are making, are giving them an extraordinary amount of money. But for every one of us, our sisters, our brothers, our cousins, even to save 10 million matters.

Let alone to make an extra 1,000,000 in other income is everything. Why should we limit those from investing in treasury bonds? Why should we limit these from investing in unit trusts? These are the people we should be encouraging every single day to take on something like this. The risk they are taking on is the premium risk that comes from being Ugandan.

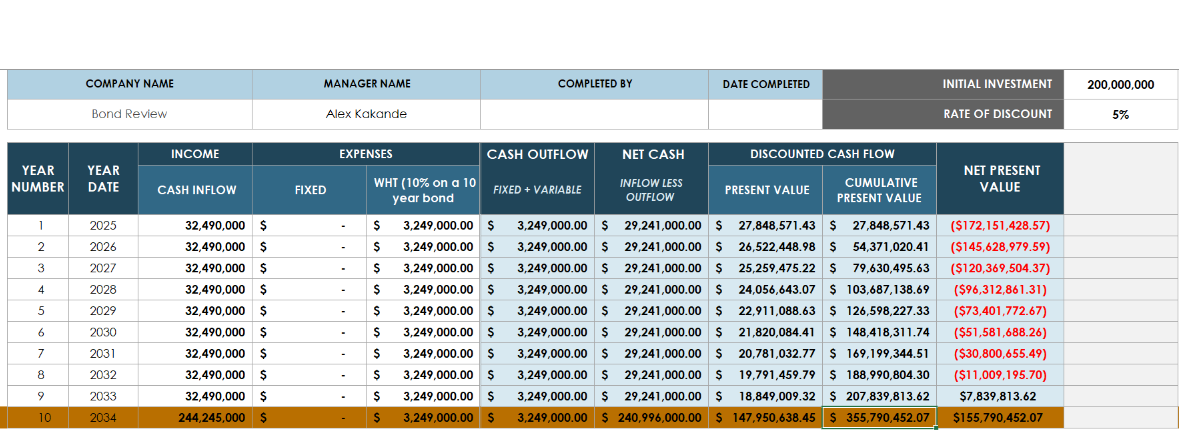

And if you have 15 million now, and can invest an extra 3.5 million per year in the treasury bond giving you just 13% return, in 10 years you will be earning 1 million per month from treasury bonds. How many other ventures can take on low amounts of capital and guarantee us that?

Do not be swayed by the idea that there is a premium risk that the country might go bad and bankrupt tomorrow. Of course, you are already in Uganda. If that risk materializes, it will hit you no matter what. If you are already in Uganda and something goes wrong, what makes you think that your business that you have set up will survive in downtown? Nothing.

Right now, treasury bonds are giving 15 to 16%, and you want people to invest. The truth is, they are giving much better returns than real estate right now. There is no doubt about that. You are better off in Bonds as an Investment Avenue.

The Return on a 200 million 10-year bond before compounding.

Vs

The return on a 200 million Mizigo rentals before compounding in 10 years

Know the Why. And it’s mostly clear for many of us

This discussion about investing in treasury bonds is for those of us who know that a single catastrophic event in the family can wipe out all our savings. It is for those of us whose primary source of income is our salaries, the jobs that we have, or the small business we operate on the side.

Every single day, especially those of us in finance, we encourage people to invest for emergencies, to put money aside. You cannot sit here and start telling people that investing in a business or buying a plot of land is investing for emergencies. That's where the brokers and those with money are taking advantage of people.

We need to be encouraging people to invest in things like money market funds and unit trust funds that allow them to invest for emergencies. No matter what, if you get an emergency, you can access your 1,000,000 or 2,000,000 to take advantage of that investment, and you're also getting a return every single day.

At one point, it's not a matter of why or if; it's a matter of when. Not all of us are going to need to dig deep into our pockets to get 2,000,000 for a medical emergency, for school fees, or for other emergencies that might arise. Yes, while successful business-people can easily withdraw profits without impacting their business, many of us are just employed. So what should we do? We cannot continue on the same path of encouraging people to just buy plots of land that they sell at a 60 to 70% loss every time they get an emergency. Yet in a money market fund, you get all your money.

In a treasury bond, you'll get your money at face value while at the same time earning more money. So why do we want to encourage people to continue on a path that has made so many fall into that trap? When our fathers and forefathers retired, they retired to their big farms, big homes, and big families.

When their pensions stopped or NSSF was finished, they had nothing. Sometimes we sit back and think, if they had time to sit back and reflect and invest their money much better, maybe in products like treasury bonds and money market funds, they would have created an alternative salary that could take care of them forever. That's what treasury bonds are offering.

This is for those of us who are thinking about the future of our children, knowing that we are their only hope for a decent education and a shot at competing in life.

Every single day, we watch movies and see things we admire in the western world. Parents create trust funds for their kids. In Kampala right now, we have a saying that says, "Plan for your kids now." From the ultra-wealthy individuals, the brandy kids have been set up with different assets that are going to provide them with as much cash flow as they need to blow and invest and take care of themselves for generations to come.

But even us in our middle-income status and poor status, we want to set up for our kids. I want my children to be able to go to the best university possible, but all I can afford is 50,000 every single month to be put aside for that investment. I can't just put it in a bank to buy land or plant eucalyptus trees. Yet if I put that 50,000 in a money market fund for 20 years, my child, by the time they graduate, will have starting capital. By the time they go to university, they will have enough money to pay for university. By the time they want to do their master's, they will have something to fund them. They can do their master's in Kenya or the United Kingdom. We can think ahead and take advantage of what the treasury bonds are giving us without burning the whole market.

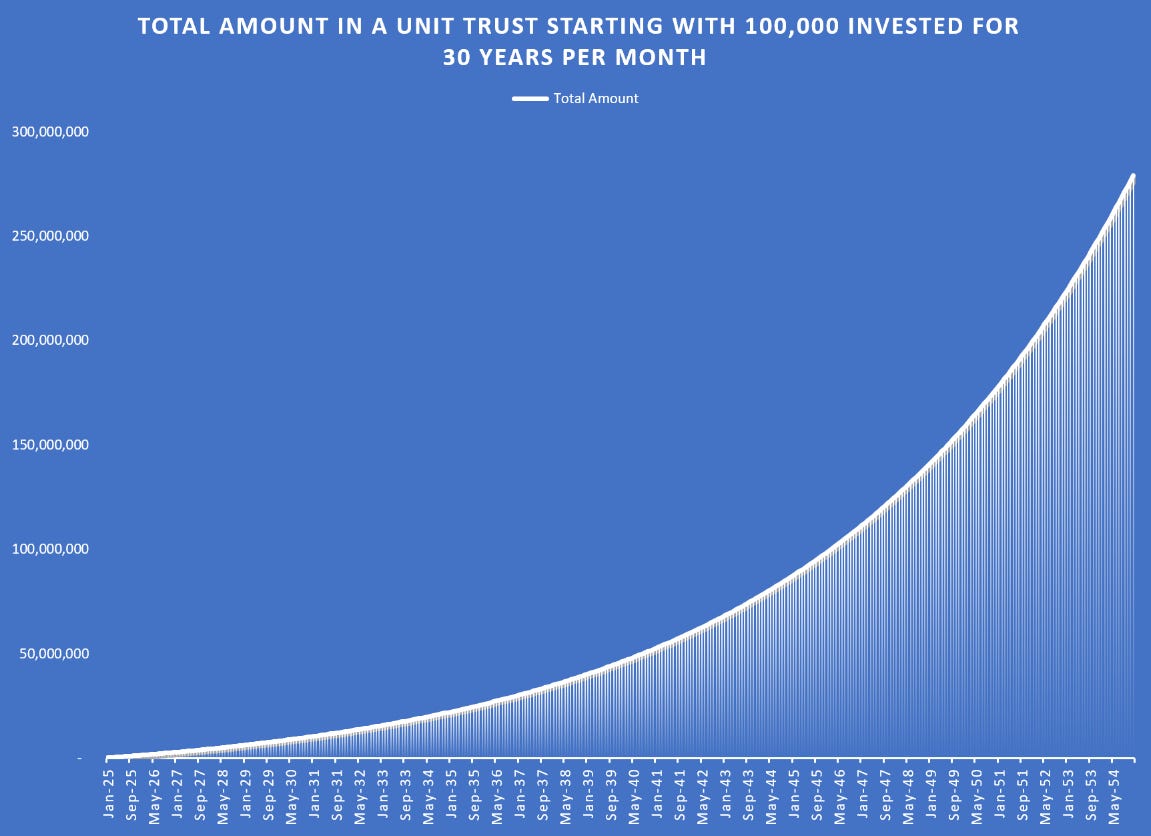

50,000 Invested in a Unit trust for 25 years at 11.5% return will give your child over 230 million when they are ready to access that cash. Just investing 50K only

An Investment plea to the Fathers and Mothers.

This is not me thinking about what the government is doing. This is me being a mother, this is me being a father, and thinking about my child. I want my child to have the best. I want my child, by the time they reach university, to be prepared. By the time they want to do their master's, they are prepared. By the time they enter the employment world, they are prepared. No matter what, I just need to open up a bank account in their names and start investing in treasury bonds.

Even if you can afford 100,000 per month, your child is five years old. By the time they are 20, that is 15 years from now, that 100,000 per month would have grown to almost 100 million plus. No matter what inflation will be and how much 100 million will be worth at that point, that would be something for them to start on. You are better off with 100 million in 20 years from now than starting with nothing in 20 years from now. That is the advantage of treasury bonds.

The graph below shows someone who deposits 100,000 per month in a Unit trust giving him/her 11%. In 30 years that Money 300 Million. So if you are 25 years, and you start now, and consistently deposit 100K for 30 years by the time you are 55 years you will have over 300 million.

Why should you invest in treasury bonds? Or at the very least, unit trusts? By investing in unit trusts, you automatically invest in treasury bonds.

We all know that investing in any product comes with a certain level of risk, and treasury bonds are not exempted. However, it's important to understand that risk is the reason why you get a return, a profit.

There aren't many opportunities in Uganda right now that can guarantee you a 14-15% return average annually by doing nothing but deploying your money. The passive investment mantra. When people talk about investing in other products or starting a business, for a moment, let's ask them what the return is right now. Those businesses are offering after-tax profits and yields. Many businesses are struggling; they are not even breaking even. They are being funded by people from other sources. The worst case is if you are employed and you start a side business and you fund it for 3-4 years from your salary until you close it. But how many businesses can beat a profit from a treasury bond that is offering over 14% per year?

When you compound that, it can go to 15%, 16%, 17%. You keep on adding money, and you're going to get 15%, 16%, 17% returns.

Very few businesses right now are comparable to treasury bonds. Even those businesses like in Tourism industry, Mining, Businesses, the people who are already in them have already concentrated them, and you cannot easily penetrate. The entry position in those businesses is extremely high, especially if it requires significant capital yet to enter a treasury bond is extremely easy. You just have to open up a bank account.

Treasury bonds are mass market for all of us. Whether you invest or not, the banks will invest that money for you in the treasury bond and make their money. That's how capitalism works. Then why don't you invest it yourself and make a profit? If you have an entrepreneurial spirit, it doesn't stop you from opening up that business you want to open. Do it. It doesn't need to compete with the treasury bond. At the same time, put some money in the treasury bond and earn some profits that are almost guaranteed, with almost a 10% real return going forward.

Some of you may have savings, say UGX 300,000 or UGX 400,000, sitting idle in the bank. What do you have to lose by putting some of that money in a unit trust or in a treasury bond? Ask yourself how much money in the last five years has been sitting in your savings bank account, sleeping. If that money was in a unit trust, it would be earning a lot of money. If that money was deposited in a treasury bond, it would be earning a lot of money.

The Graph below shows someone who dedicates just 300,000 per month buying a long term Treasury bond for 30 years to one wake up to a 1.3 billion in total bonds. That’s the power of starting early and compounding your investments. So what is not your reason?

You are gainfully employed in a reputable company. After expenses, you can save 400,000. You go buy a treasury bond every single month or put it in a unit trust. Do it for 10 years. I assure you that 400,000 would have grown to almost 80 million or 100 million. Do it for 20 years, and you are looking at retiring with 300 million in assets that are giving you almost 1,000,000 in income. So why don't you think ahead and plan it better? You don't need to start with a lot of money. You do not need 100 million. You do not need 10 million. You just need to start with the little you have but be willing to stay the course. Be willing to invest that money every single time you have it and leave it to grow, leave it to compound, and leave it to double in value for you to take advantage of that.

Some people who have managed successful companies refer to this as lazy investing. But when your money is working for you, you are earning more. Let them call us lazy. Let them call you lazy for doing lazy investing. At least you can afford whatever you can afford. If you are investing to take care of your family, if you are investing to grow your net worth, if you are investing to take that trip to Dubai or the United Kingdom, if you are investing to go for further education, if you are investing for whatever ambition you have, as long as the return is coming back, that is not lazy investing. If the biggest companies employ people to just invest in treasury bonds, what they call fixed incomes globally, who are you not to? This mindset of suffering, that for me to be seen as succeeding, I must first sweat my blood and toil and everything, is not true. In the world of smart opportunities, now that you know about treasury bonds, invest. When they say, "Oh no, no, no, no, no, it's killing the other markets," whatever the case, that market is not your responsibility. Your responsibility lies with your micro-assessment of your product, your micro-assessment of your portfolio, your micro-assessment of your responsibilities.

Soon bonds will be yielding an expected return of over 17.5%. Why not Invest?

I assure you, if your family cannot afford a meal, however much the other industries are succeeding, you would have failed. If the economy is struggling to pay teachers' salaries and the government can't afford to pay salaries, but you can afford to make a profit off your money market fund, you will have something to feed your family. When the roads are poor in the economy, it's the business of the minister and the government of the day. Your business is to ensure your roads at home are good, your kids have something to eat, your medical bills are paid, your insurance is taken care of, and your school fees are paid. It has nothing to do with being lazy. It has everything to do with being strategic, using the resources you have, growing them, and being patient enough to see that return come to life.

If you don't invest in treasury bonds, where would you invest your money? If it's just sitting in the bank, it's yielding less than 2% interest. Yet when you go to borrow money, the interest is astronomically higher, usually 17-18%, even as high as 19%. Others will tell you to invest in real estate, as that has been the common ground for many years.

I agree with you, real estate makes money, but right now, 80% of real estate products are weak and terrible, and treasury bonds are beating them every single day. Especially depending on you as a person, if all you have is a certain million, do not buy a plot of land in Maya. Do not buy a plot of land in Kyengera in those terrible estates. Put that money in a unit trust.

Such Acquisitions and if not well planned will make your Investment seat for a long term, like this house seating on 100*100 in Maya that has been on market for 1 year and owner is asking 150 million, plan better, invest your money wisely

Give it five years to grow, to double itself. Get that 30 million, buy a treasury bond for 10 years, leave it there for 10 years, and see that money grow from 30 million to 90 million. Then you will go and buy a better plot of land. Then you will construct better housing. There are very few businesses you can do right now in Kampala that can give you that return, especially if you are fully and gainfully employed. Especially if you are fully and gainfully employed and your job is still escalating your career.

You are outside of Uganda, trying to build your career. Why then do you want to come and start investing in something you cannot even supervise? Don't take it wrong. If you want to, if your passion has always been doing farming, one day you will do it, but maybe it's not the right time. If it's not the right time, do not leave that money in a bank account for it to earn nothing. Put it in a treasury bond and let it earn something.

I understand the struggles of being a Ugandan investor. Many of us have been employed for the last five years and have managed to start some enterprises, but they have not always succeeded. As someone who spent nearly three years operating a small business selling Daddies to former colleagues, I can tell you that while it provided reliable income, it was not enough to take me to the next level.

The sad truth is that in Uganda, 90% of businesses die before they reach their 5th year. That's a staggering statistic from the Uganda Bureau of Statistics. Meanwhile, those who deploy their money in treasury bonds would have doubled their investment in that same timeframe. (What will it be for you? Be part of the 90% or the almost sure win?)

Therefore, investing in treasury bonds seems to be an advantageous solution, especially for the middle-class society, the lower middle-class society, and the poor, where many of us fall. It gives us a chance to earn something while we still focus on our careers and building them.

This by no means implies that the inherent risk of investing and being in Uganda is low, nor does it stop us from going about our businesses. Investing in a treasury bond does not stop us from chasing our goals and our paths and our careers. If you are a successful lawyer, it does not stop you from being a lawyer and being the best lawyer you can be. If you are a successful business person, it does not stop you. If you are reading this and you are in Dubai, Europe, or the US, and you are successful at what you are doing, continue doing that. It does not stop you from investing in the treasury bond. Even if the risks we have as a country are there, for the last many years, 50 years, the bonds have been there, and the treasury bills and the government of the day have continued to pay us. Let no one scare you. Yes, the horizon of our political risk is getting gray and gray.

But here's what else you can do. Even if you have to start a business, it will struggle—not because you are not good, but because politics affects everything. So, I might as well put my money where I can make a little bit more money. If I put 100 million right now in a treasury bond, in five years, I would have gotten back most of the money. By the time the political risk comes through, you'll be enjoying the profits. How many businesses do that? How many businesses return capital in five years in Kampala? Not so many.

The many challenges that come with being a Ugandan, such as political instability, high taxes, and weak infrastructure, have never stopped us from bargaining for better working conditions. Nor has it stopped those in the tourism industry from further investment in the sector and promoting Uganda as the destination of choice. They found a way to earn a living. Find yours too, and if your way is served by Unit Trusts or Treasury Bonds, so be it. Do it boldly.

We are all aware of the risks involved in investing in land or other commodities. Yet that hasn't deterred us from buying land or investing in agriculture. We take on these risks and invest every now and then by utilizing our limited resources, either directly or through relatives.

Don't be swayed by the naysayers. Treasury bonds offer a globally recognized and respectable way to invest your money. Regardless of the challenges you face, it is important to have a warm meal on your table. Hence, if investing in treasury bonds will help you achieve that, then by all means, go ahead and invest.

Instead of shying away from treasury bonds due to fear of being termed "lazy investors," we need to appreciate the true nature of our circumstances. We are not blessed with ample resources; instead, we have the spirit to maximize what we do have.

Investing in treasury bonds is not about promoting lazy investing; it's about taking advantage of the opportunities before us. If the government is offering 18%, why would you think twice before investing? Let's not forget, when inflation hits, it affects us all. But if you had invested in a treasury bond, at least you'd be better prepared. Investment should be about how much you are making and how best you can secure your financial future.

The goal is not always entrepreneurial excellence or success. Sometimes, the objective is merely survival and growth within our means. Such modest goals do not require extraordinary skills or resources. They merely require capital. The simple act of redirecting idle money from a bank account to a unit trust or treasury bonds investment can reap significant benefits.

Back in 2015, treasury bonds were offering 19-20%, a substantial return compared to many other forms of investments. Anyone who bought a ten-year bond in 2015 would have tripled or even quadrupled their money by now. Even in 2022, the offering was as high as 18.5%.

Looking at Kenya, between 2020 and 2021, treasury bonds were offering 9-10%. However, with the advent of the euro bond market and changes in political leadership, the risk profile of the country changed dramatically. In response, for about a year, their bonds offered between 18 and 19%.

There are those who saw these developments as great opportunities and made investments accordingly. Others hesitated, questioning the credibility of the "Zacharias" government and fearing default. These actions reflect our nature as Ugandans—fearful and yet courageous, hesitant and yet willing to take bold risks.

While entrepreneurs may advise against investing in treasury bonds, we must remember that even those entrepreneurs probably generate much of their revenue through contracts with the government or government liaisons. If the biggest consumer in Uganda is the government, why then should we, ordinary Ugandans, not also do business with the government by investing in treasury bonds?

Being poor does not equate to the end of hope. It simply means we work harder and smarter, that we look at opportunities like treasury bonds as lifesavers to deploy our small resources.

Wise investing means being alert to opportunity, making use of existing resources, and always having an eye on the future. In the end, this isn't about lazy or aggressive investing. It's about smart investing—doing what is best for you and your family.

Thanks for the insightful piece. I can ably say that " I was blind but now I can see" You have actually hit a swarm of bees and decisions and resolutions have been made to invest in money market funds (unit trusts) and treasury bonds. Where as unit trusts, the reinvestment is automatic, for the treasury bonds, I have to do bond laddering as to invest continuously.

As for the future generations, you have ably shared how I can invest on behalf of the children so as to leave a LEGACY.

Thanks for always coming out to inform generations.

As for employees who find supervision of personal projects challenging, this literature in a masterpiece.

I will be looking forward to attending one of the upcoming masterclasses on treasury bonds and money market funds so that I can get the numbers right.

Kudos!

You have nailed it spot on. Many Ugandans unfortunately believe in "ego investing." They want a house, land, shop etc. tied to their names and that is what give them happiness. Many hardly think about "returns to capital." Ask any at random when they think that "ego thing" will break-even and they have no clue.

Bond investing is:

1. Entrepreneural in the sense that we who invest seek the high returns that no alternative can offer.

2. Patriotic since we are dealing with our country. How would a businessman shout "buy Uganda build Uganda" when s/he cannot facilitate the government to provide security and services needed to thrive his or her production.

3. Long term. Survival entrepreneurs seek quick returns. They are hardly sure of their enterprises living in the future. Bond gives us a 5, 10, 15, and 20 years outlook of undeterred returns.

4.Beating volatility in the market. The stable pay and cash over the long term actually instead of being called lazy gives me ample time, call it freedom, to do whatever I want without any headache of how I will earn to afford my humble lifestyle.

Like we discussed before let those who want to sweat blood to earn sweat. Let those seeking after their ego go. But all said and done, I have come to a simple conclusion that "financial wealth is not meant for everyone" and perhaps thatbie why it's pointed out that "the poor you will always have."