This discussion is an argument for investing in treasury bonds. It's targeting those of us who, by the very nature of being Ugandans, are already working against the tides. Many of us who are fully employed and have a starting capital of A0 or are earning anywhere from 2,000,000 to 3,000,000 or less than 1,000,000.

This includes our sisters who are employed in all manner of countries as housemaids and the majority of us whose prospects are not many. The only prospect we have is to use the little we have to grow it. This discussion is for those who are still in what many term as the "food war".

This discussion about investing in treasury bonds is for those of us who know that a single catastrophic event in the family can wipe out all our savings. It is for those of us whose primary source of income is our salaries, the jobs that we have or the small business we operate on the side.

This is for those of us who are thinking about the future of our children, knowing that we are their only hope for a decent education and a shot at competing in life.

Why should you invest in treasury bonds? Or at the very least, unit trusts? By investing in unit trusts, you automatically invest in treasury bonds.

We all know that investing in any product comes with a certain level of risk, and treasury bonds are not exempted. However, it's important to understand that risk is the reason why you get a return, a profit.

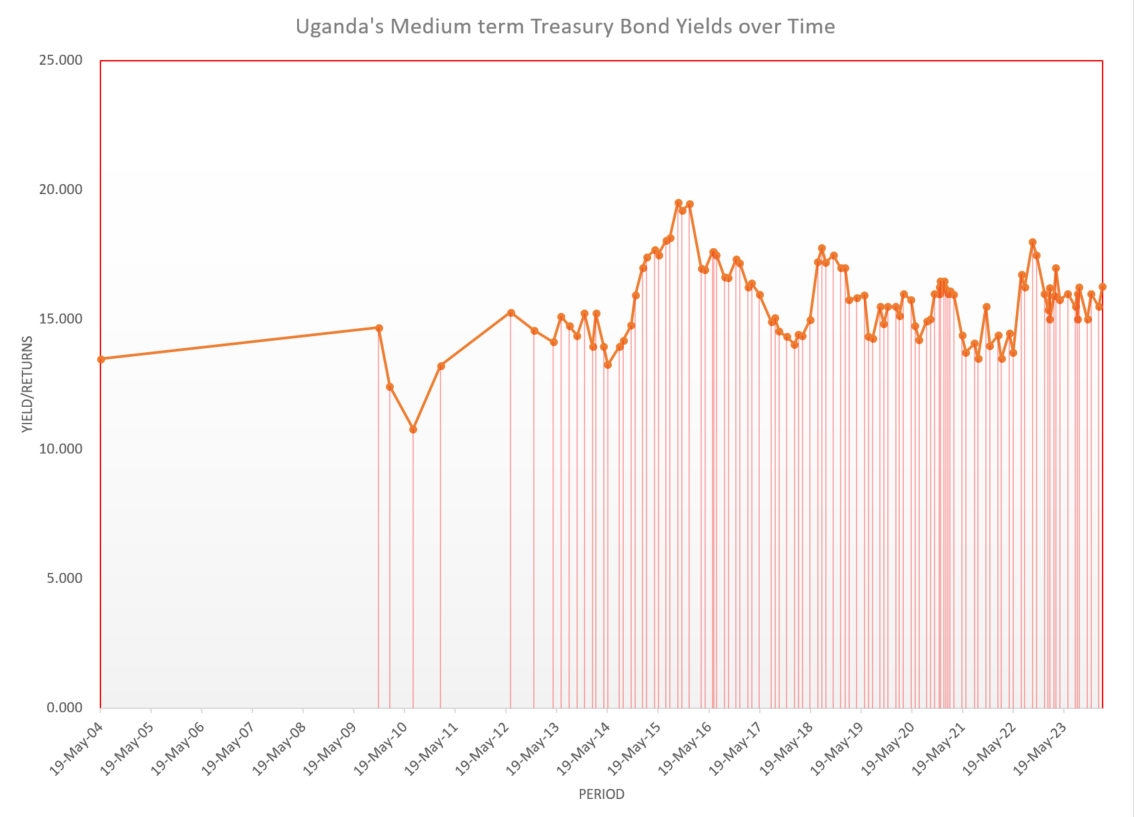

There aren't many opportunities in Uganda right now that can guarantee you a 14-15% return average annually by doing nothing but deploying your money. The passive investment mantra.

Some of you may have savings, say UGX 300,000 or UGX 400,000, sitting idle in the bank. What do you have to lose by putting some of that money in a unit trust or in a treasury bond?

Some people who have managed successful companies refer to this as lazy investing. But when your money is working for you, you are earning more.

If you don't invest in treasury bonds, where would you invest your money? If it's just sitting in the bank, it's yielding less than 2% interest. Yet when you go to borrow money, the interest is astronomically higher, usually 17-18%, even as high as 19%.

I understand the struggles of being a Ugandan investor. Many of us have been employed for the last five years and have managed to start some enterprises, but they have not always succeeded. As someone who spent nearly three years operating a small business selling Daddies to former colleagues, I can tell you that while it provided reliable income, it was not enough to take me to the next level.

The sad truth is that in Uganda, 90% of businesses die before they reach their 5th year. That's a staggering statistic from the Uganda Bureau of Statistics. Meanwhile, those who deploy their money in treasury bonds would have doubled their investment in that same timeframe. (What will it be for you? Be part of the 90% or the almost sure win)

Therefore, investing in treasury bonds seems to be an advantageous solution, especially for the middle-class society, the lower middle-class society, and the poor, where many of us fall in. It gives us a chance to earn something while we still focus on our careers and building them.

This by no means implies that the inherent risk of Investing and being in Uganda is low, nor does it stop us from going about our businesses.

The many challenges that come with being a Ugandan, such as political instability, high taxes, and weak infrastructure, never stopped us from bargaining for better working conditions or has never stopped those in the tourism industry from further investment in the sector and promoting Uganda as the destination of choice, they found a way to earn a living, find yours too, and if your way is served by the Unit Trusts or Treasury Bonds, so be it, do it boldly.

We are all aware of the risks involved in investing in land or other commodities. Yet that hasn't deterred us from buying land or investing in agriculture. We take on these risks and invest every now and then by utilizing our limited resources either directly or through relatives.

Don't be swayed by the naysayers. Treasury bonds offer a globally recognized and respectable way to invest your money. Regardless of the challenges you face, it is important to have a warm meal on your table. Hence, if investing in treasury bonds will help you achieve that, then by all means, go ahead and invest.

Instead of shying away from Treasury bonds due to fear of being termed a "lazy investors" we need to appreciate the true nature of our circumstances. We are not blessed with ample resources; instead, we have the spirit to maximize what we do have.

Investing in treasury bonds is not about promoting lazy investing but it's taking advantage of the opportunities before us. If the government is offering 18%, why would you think twice before investing? Let's not forget, when inflation hits, it affects us all. But if you had invested in a treasury bond, at least you'd be better prepared. Investment should be about how much you are making and how best you can secure your financial future.

The goal is not always entrepreneurial excellence or success. Sometimes, the objective is merely survival and growth within our means. Such modest goals do not require extraordinary skills or resources. They merely require capital. The simple act of redirecting idle money from a bank account to unity trust or treasury bonds investment can reap significant benefits.

Back in 2015, treasury bonds were offering 19-20%, a substantial return compared to many other forms of investments. Anyone who bought a ten-year bond in 2015 would have tripled or even quadrupled their money by now. Even in 2022, the offering was as high as 18.5%.

Looking at Kenya, between 2020 and 2021, treasury bonds were offering 9-10%. However, with the advent of the euro bond market and changes in political leadership, the risk profile of the country changed dramatically. In response, for about a year, their bonds offered between 18 and 19%.

There are those who saw these developments as great opportunities and made investments accordingly. Others hesitated, questioning the credibility of the "Zacharias" government, and fearing default. These actions reflect our nature as Ugandans - fearful and yet courageous, hesitant and yet willing to take bold risks.

While entrepreneurs may advise against investing in treasury bonds, we must remember that even those entrepreneurs probably generate much of their revenue through contracts with the government or government liaisons. If the biggest consumer in Uganda is the government, why then should we, ordinary Ugandans, not also do business with the government by investing in treasury bonds?

Being poor does not equate to end of Hope, it simply means we work harder and smarter, that we look at opportunities like treasury bonds as lifesavers we deploy our small resources.

Wise investing means being alert to opportunity, makes use of existing resources, and always having an eye on the future. In the end, this isn't about lazy or aggressive investing. It's about smart investing - doing what is best for you and your family.

Great article Alex.

One thing still remains. Financial education is the antidote and through such knowledge, people can leverage such opportunities and build wealth unapologetically.

The sad truth is that in Uganda, 90% of businesses die before they reach their 5th year. That's a staggering statistic from the Uganda Bureau of Statistics. Meanwhile, those who deploy their money in treasury bonds would have doubled their investment in that same timeframe. (What will it be for you? Be part of the 90% or the almost sure win)?? Is it possible to double initial lumpsum payment in 5 years at annual growth rate of 10%??!?