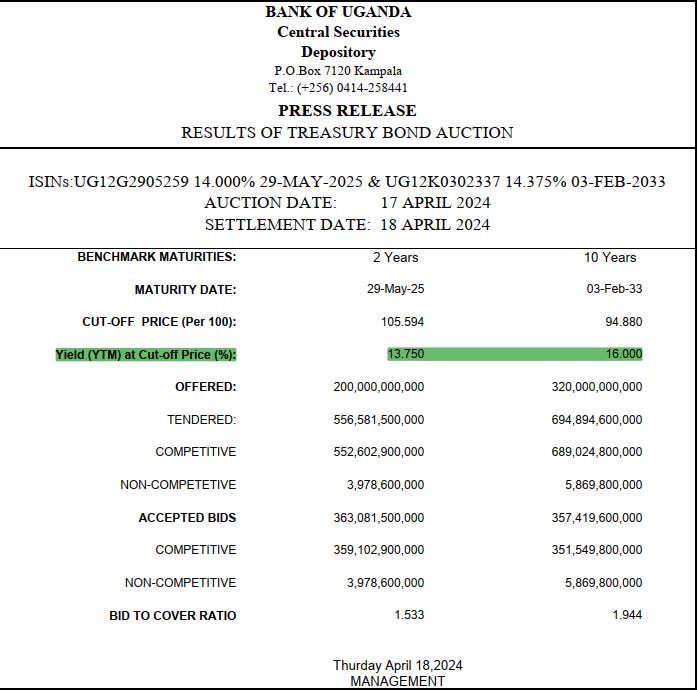

Today’s Treasury Bond Auction results are out and the critical number to focus on is the 10 year Treasury bond Cut off price of UGX 94.88 and the Yield of 16% closing is in on the Yields we have been seeing in the 15 year and 20-year tenors.

For Comparision, the last time the 10-year treasury bond auctioned off in the primary market in January 2024, it yielded around 15.5% and 3 months later we are seeing a rally of 50 Basis point above the last Auction. Will this rally continue in the future especially as Government revenue from External sources continue to dwindle?

Back to today’s results.

With a cut-off yield set at 16%, an investor purchasing a bond with a face value of 10 million only needed to spend only 9.48 million. This translates to a savings of about UGX 500,000 on the transaction. Additionally, factoring in an accrued interest income of UGX 248,000, the real savings on this investment amount to approximately UGX 760,000.

Consequently, investors were able to secure a net yield of around 14.4% for the remaining nine years, making this an attractive medium-term investment option with a favorable rate.

Cashflows - At 14.375%, that person would earn on average of UGX 646K per every 6 months starting August 15, 2024 (around 120 days from now).

Happy Investing Everyone.